Recent insider trading activity has caught the attention of market analysts as Dave Schaeffer, the Chairman, CEO, and President, as well as a 10% Owner of Cogent Communications Holdings Inc (NASDAQ:CCOI), sold a significant number of shares in the company. On December 13, 2023, the insider executed a sale of 20,000 shares, a move that prompts a closer examination of the implications for investors and the company’s stock valuation.

Who is Dave Schaeffer?

Dave Schaeffer is a key figure at Cogent Communications Holdings Inc, serving as the company’s Chairman, CEO, and President. His leadership has been instrumental in steering the company’s strategic direction and growth. Schaeffer’s tenure at Cogent has been marked by a focus on delivering high-quality internet, Ethernet, and colocation services to businesses and net-centric customers. His insider status and substantial ownership stake in the company make his trading activities particularly noteworthy to investors seeking insights into the company’s performance and future prospects.

About Cogent Communications Holdings Inc

Cogent Communications Holdings Inc is a multinational internet service provider specializing in delivering high-speed internet access and point-to-point network services. With a robust network infrastructure, Cogent serves a diverse clientele, including small businesses, large enterprises, and other internet service providers. The company’s commitment to providing reliable and affordable bandwidth has positioned it as a competitive player in the telecommunications industry.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider trading patterns, particularly those involving high-ranking executives, can provide valuable clues about a company’s internal perspective on its stock’s value. Over the past year, Dave Schaeffer has sold a total of 318,191 shares and has not made any purchases. This one-sided transaction history could suggest that the insider perceives the stock’s current price as favorable for selling rather than buying.

The broader insider transaction history for Cogent Communications Holdings Inc reveals a trend of 0 insider buys and 41 insider sells over the past year. This pattern of more frequent selling than buying among insiders might raise questions about their confidence in the company’s near-term growth potential or valuation.

On the day of Schaeffer’s recent sale, Cogent Communications Holdings Inc’s shares were trading at $69.99, giving the company a market cap of $3.492 billion. The stock’s price-earnings ratio of 3.18 is significantly lower than both the industry median of 16.04 and the company’s historical median, suggesting that the stock may be undervalued relative to its peers and its own past performance.

Story continues

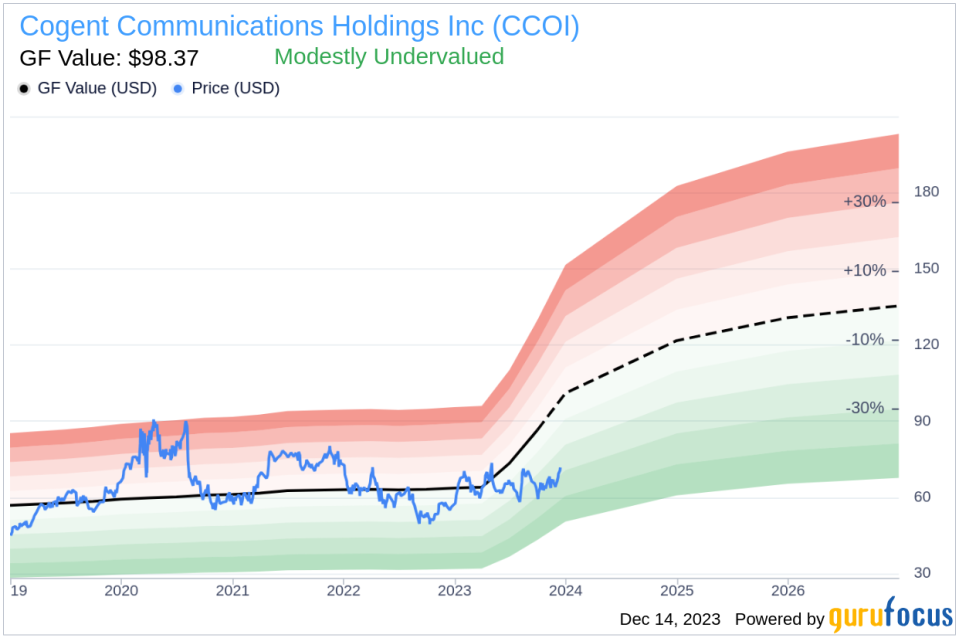

Adding to the valuation analysis, the price-to-GF-Value ratio stands at 0.71, with the GF Value at $98.37. This indicates that Cogent Communications Holdings Inc is modestly undervalued based on GuruFocus’s intrinsic value estimate, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

Insider Sell: Cogent Communications’ Dave Schaeffer Unloads 20,000 Shares

The insider trend image above provides a visual representation of the selling pattern, reinforcing the data that insiders have been more inclined to sell shares over the past year.

Insider Sell: Cogent Communications’ Dave Schaeffer Unloads 20,000 Shares

The GF Value image further illustrates the stock’s current valuation status in relation to its intrinsic value, supporting the argument that the stock may be trading at a discount.

Conclusion

The recent insider sell by Dave Schaeffer is a significant event that warrants attention from current and potential investors. While the insider’s decision to sell shares could be interpreted in various ways, it is essential to consider the broader context of the company’s valuation metrics and market performance. Cogent Communications Holdings Inc’s lower-than-average price-earnings ratio and modestly undervalued GF Value ratio suggest that the stock may be an attractive investment opportunity, despite the insider’s recent sell-off.

Investors should weigh the insider trading trends alongside other fundamental and technical analyses to make informed decisions. As always, it is recommended to consult with financial advisors or conduct thorough personal research before making any investment decisions based on insider trading activity.

For more detailed insights and analysis, stay tuned to gurufocus.com, where we provide up-to-date information on insider trading patterns, stock valuations, and investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.