Wed Mar 12, 2025 12:00 AM

Last update on: Thu Mar 13, 2025 11:23 PM

Wed Mar 12, 2025 12:00 AM Last update on: Thu Mar 13, 2025 11:23 PM

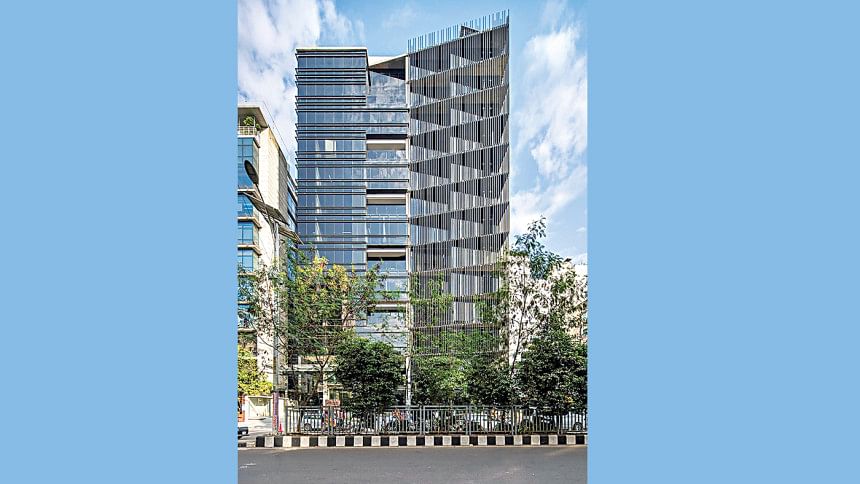

Centroid

Photo Courtesy:

Navana Real Estate

“>

Centroid

Photo Courtesy:

Navana Real Estate

In the bustling urban centers of Bangladesh, the skyline is evolving rapidly, punctuated by commercial hubs that house businesses of all scales. As more global brands enter the market and local businesses scale up, the need for well-located office spaces, retail outlets, and industrial hubs has skyrocketed. However, for many enterprises, the high upfront costs of acquiring commercial properties remain a significant barrier.

A commercial space loan is not merely a means of acquiring property; it is an investment in the future. It enables businesses to secure a foothold in prime locations, enhance their brand presence, and build long-term assets rather than commit to perpetual rent payments. “Considering the complexities of buying properties, real estate companies simplify the process for their clients by providing all necessary documents for taking loans. They ensure seamless transactions by securing the required approvals during land acquisition,” mentioned Mehedi Rana Meheran, Head of Sales at Credence Housing Ltd. In a landscape where access to capital fuels or stagnates the success of an enterprise, understanding the nuances of commercial real estate loans is the key to staying ahead.

For all latest news, follow The Daily Star’s Google News channel.

How do commercial real estate loans function?

Unlike personal or residential property loans, commercial space financing operates under distinct parameters. Banks and non-banking financial institutions (NBFIs) assess loan applications based on business viability, projected cash flow, and collateral value. Loans are usually provided both for purchasing and constructing commercial spaces. The tenor for such loans typically ranges between one to fifteen years, depending on the loan amount with interest rates varying based on the financial institution.

Most commercial space loans in Bangladesh are structured as term loans, where the borrower repays the principal with interest in fixed installments. Some institutions offer flexible repayment schemes, aligning with business revenue cycles to ease financial strain. Loan amounts generally cover 60-80% of the property’s value, requiring a substantial down payment from the borrower. In addition to the standard mortgage model, lease financing has gained traction, particularly for businesses that require high-value spaces but prefer not to commit to outright ownership.

Most commercial space loans are structured as term loans, where the borrower repays the principal with interest in fixed installments.

“>

Most commercial space loans are structured as term loans, where the borrower repays the principal with interest in fixed installments.

Available borrowing options for your dream business

Almost all banks and many NBFIs offer loan options for purchasing commercial spaces or constructing factory/office space for various businesses. For instance, under their SME loan schemes, Dhaka Bank has financing facilities for building, renovating or procuring commercial buildings. “We provide two types of loans for commercial spaces: factory construction and construction of buildings for rental purposes. There is also scope for loans for purchasing commercial space as well, however not many people take this type of loan. Additionally, we offer project-based loans to real estate developers looking to construct office spaces, with a maximum tenor of six years,” mentioned Subrata Kumer Saha, FVP & Manager, CRM at Dhaka Bank.

Similarly, NCC Bank offers BDT 20 lac to 10 crore term loan for commercial buildings with a tenor ranging from 1 to 10 years. This loan is given for construction and/or renovation of commercial complexes for rental purposes. BRAC Bank also finances commercial housing under their NIRMAN SME Loan scheme. This installment based loan amounts to BDT 5 lac to 5 crore, with both mortgage free and mortgage backed facility. The scheme has a flexible tenor of up to 60 months for semi-pucca building and up to 120 months for multistoried building.

MDB Nirman scheme of Midland bank supports entrepreneurs who own land in urban, semi-urban, outskirts, and rural areas with commercial potential to generate higher rental income. “MDB Nirman scheme is provided to small-and-medium entrepreneurs looking to construct residential or commercial buildings for earning rent,” commented Mr. Md. Rashed Akter, Executive Vice President, Head of Retail Distribution Division, Midland Bank. He further added that this loan finances targeted customers to acquire, construct, or renovate shops, commercial spaces, small markets, dormitories, labour sheds, single-storey semi-pucca/tin-shed structures, or multi-storey buildings for rental purposes.

For semi-pucca and one-storied buildings the loan size is maximum BDT 50 lac with a tenor of 8 years, whereas BDT 200 lac with a tenor of maximum 15 years is offered for multi-storied buildings. Under this scheme, one can also avail of multiple facilities against the same property or different property but combined exposure cannot exceed BDT 50 lac for semi-pucca building and BDT 200 lac for multi storied building. Combination of both semi-pucca and multi storied is allowed but in that case maximum limit shall not exceed BDT 200 lac.

For construction financing under this scheme, a grace/moratorium period of up to six months may be granted based on the banker-customer relationship. However, total loan tenor cannot exceed 8 years for semi-pucca buildings and 15 years for multi-storey buildings or the sanctioned tenor. Interest during the grace period can be paid monthly or added to the remaining installments, with any balance adjusted in the final installment.

Centroid, Photo Courtesy: Navana Real Estate

“>

Centroid, Photo Courtesy: Navana Real Estate

Prime Bank has two schemes, i.e., Prime Emarat and Prime Sampad for financing commercial spaces. Prime Emarat offers loan up to BDT 10 crore with a tenor of 10 years for construction/expansion/renovation of semi-pucca or pucca commercial complex, shops, offices, warehouses of factories. A special feature of this scheme is that it offers unsecured loans up to BDT 30 lac. Moreover, Prime Sampad lends up to BDT 5 crore for 7 years for business expansion and acquiring fixed assets, such as plant, buildings and commercial spaces.

EBL Uddipon of Eastern Bank offers financing for any purchase, construction and renovation of commercial spaces for rental or other business purposes. The loan limit ranges from BDT 10 lac to 25 crore with flexible tenor of 12 to 180 months. The scheme requires a registered mortgage on land and/or building as collateral security with the repayment facility in monthly installments.

Furthermore, NBFIs like IDLC Finance and National Housing offer tailored Commercial Space Purchase Loans, enabling business owners to acquire office or factory space and maintain full control over their business premises. IDLC finances up to 70% of the property including registration costs, with maximum tenor of 10 years. This scheme has special facilities for independent professionals, such as doctors, chartered accountants, dentists, architects.

Requirements for securing a loan

To obtain loans for commercial space, either for construction or purchase, certain documents and compliance requirements must be maintained, regardless of which institution you are applying for a loan. For successful approval, businesses must have a valid trade license, or special license where applicable (e.g., drug license or environmental certificate), operating for at least one or more years. Valid ownership documents, such as property ownership deed, land rent (khajna) receipt, latest municipal tax payment receipt (if the property is located at municipality area) are also usually required.

Saha from Dhaka Bank summarised the most common requirements for this type of loan, saying, “To apply for a loan, applicants must provide a trade license, construction approval from RAJUK or the relevant city corporation (if required), legal vetting, and proof of a sustainable income flow. Additionally, construction projects must comply with standards, ensuring violations do not exceed 15% to qualify for approval.”

Additionally, business operations must comply with local laws and not be hazardous to the environment. In case of salaried professionals, personal documents like employment/salary certificate, copy of updated TIN certificate, recent bank statement may be required as well. Additionally, applicants must be Bangladeshi, with a minimum age requirement of 21 years in most cases

“The loan process has become easier than before, especially if the required documents are provided properly. The bank mainly evaluates the return capacity of the customers, and whether they will be able to pay installments depending on their business cash flow,” said Shah Md. Moinuddin, Independent Director at NRB Bank.

For businesses and investors looking to secure commercial properties, strategic financial planning is paramount. Engaging with experienced financial advisors, conducting thorough market research, and maintaining a strong credit profile can make a substantial difference in securing favourable loan terms.

The future of commercial space financing in Bangladesh

As Bangladesh continues its trajectory of economic growth, the demand for commercial spaces will only intensify. With urban expansion, infrastructural advancements, and increasing foreign investment, the commercial real estate sector is poised for a significant boom. However, the financing landscape must adapt accordingly.

Future trends may include more innovative financing solutions such as Real Estate Investment Trusts (REITs), which allow investors to pool funds for large-scale property development, thereby reducing individual risk. Fintech-driven lending solutions, incorporating AI-based credit assessments and blockchain for secure transactions, could streamline loan approvals and enhance transparency in the financing process.

Commercial space loans are more than just financial transactions—they are the backbone of enterprise growth, urban transformation, and wealth creation. For those with the vision to build, expand, and invest, the right financing can be the key to unlocking untapped potential.