InvestorPlace – Stock Market News, Stock Advice & Trading Tips

Triple-A mortgage bonds are defaulting … keep your eye on regional banks … even with rate cuts, refi rates will be painful … what to do in your portfolio

In 2014, private equity giant Blackstone purchased a Manhattan skyscraper using $308 million of mortgage bonds to help pay for it.

These bonds were triple-A. The safest of the safe. What could go wrong?

By 2022, the largest tenant in that Manhattan skyscraper had moved out, vacating 77% of the space. Blackstone could no longer make the numbers work, and they handed over the keys to their lenders.

Owners of the mortgage bonds, which included MetLife and Farmers Insurance, lost at least 25% of their money.

Today, the commercial real estate meltdown is spreading into the bond market

A wave of real estate bond defaults is raising questions about what’s going to happen with offices and malls throughout the country.

Let’s go to The Wall Street Journal from earlier this week:

There are about $260 billion of the deals, known as single-asset, single-borrower bonds, held by investors such as banks, insurers, pensions and mutual funds.

Landlords, often private-equity firms, used that money to purchase skyscrapers, shopping centers and other properties.

Much of the debt is coming due and refinancing markets are frozen for many office and retail landlords.

Some are defaulting even before their due dates because their interest expenses soared when the Federal Reserve raised rates.

These “SASB” bonds were supposed to be ultra-conservative. Credit-rating firms gave many of them a rating of triple-A, which is the highest (safest) rating. This is why it’s alarming to see the rate of SASB loans that are at or near default almost tripling in just two years.

Back to the WSJ:

SASB bonds backed by malls and offices are already in default in Chicago, Los Angeles, New York, Philadelphia and San Francisco.

Some properties are still hanging on but struggling to attract tenants, pushing prices of their lower-rated bonds below 20 cents on the dollar.

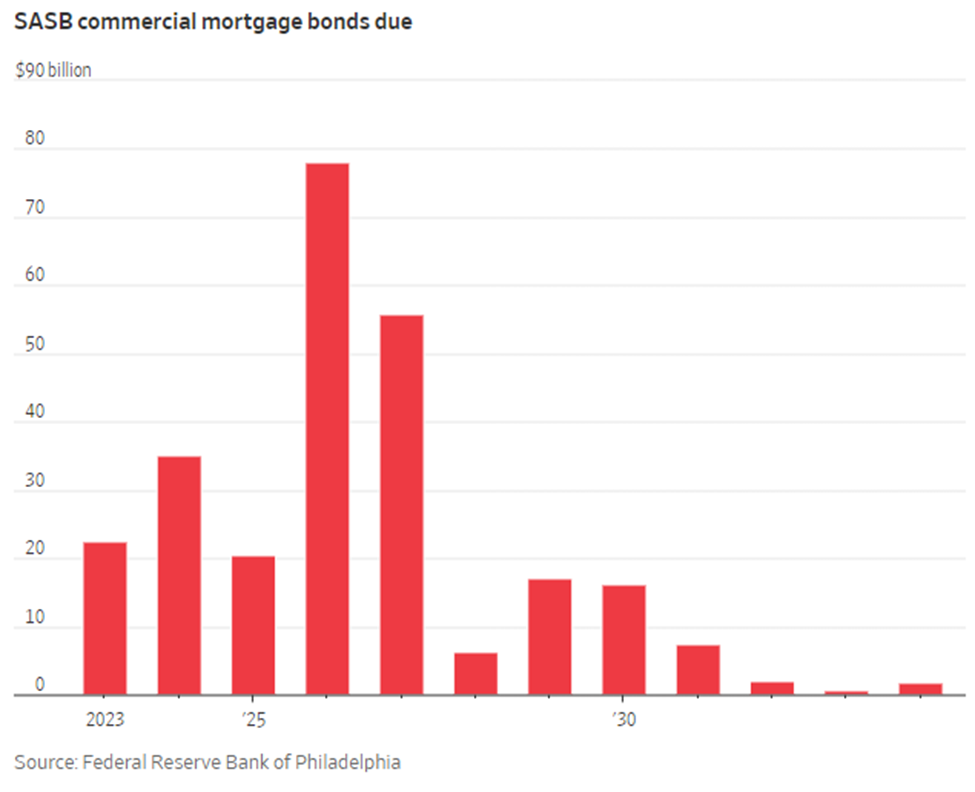

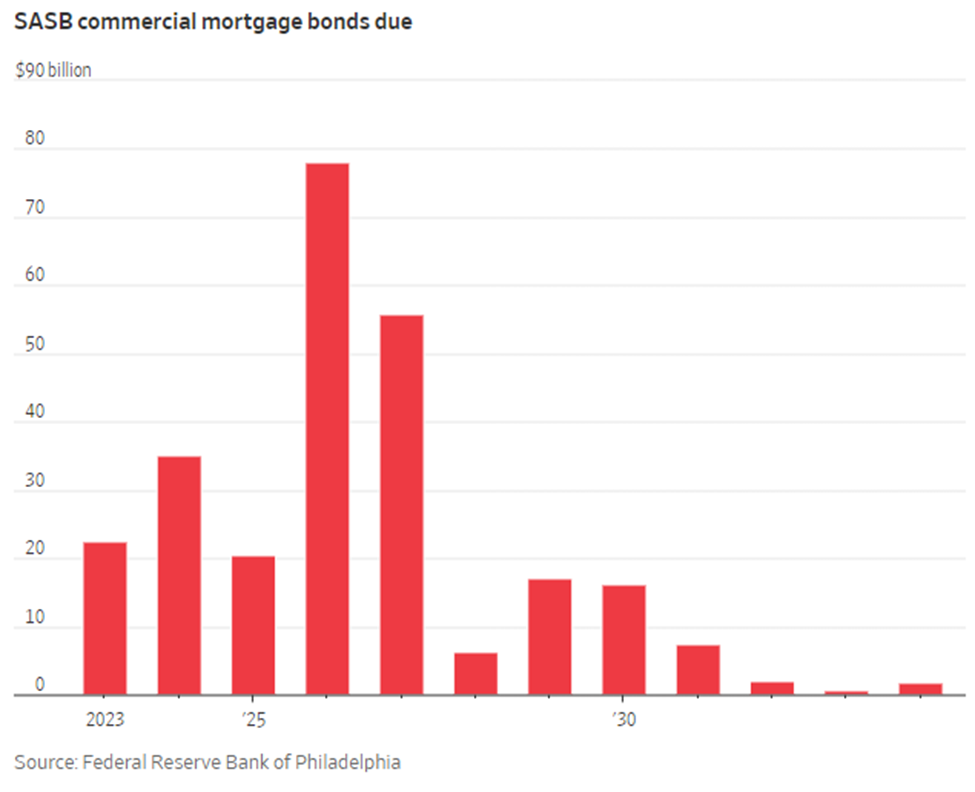

The chart below shows when SASB commercial bonds will be coming due. The huge spike you see represents $78 billion worth of bonds hitting maturity in 2026.

Source: Federal Reserve data / WSJ

Meanwhile, investors also need to keep their eye on regional banks

We’ve been tracking regional banks in our ongoing “Commercia Real Estate Watch” segment over the last two years since they account for a whopping 67% of all commercial real estate lending. Last month, we learned how much risk exists within the sector.

Researchers at Florida Atlantic University found that more than 60 banks are at risk of failure due to their commercial real estate exposure.

From Florida Atlantic University’s News Desk:

Sixty-seven banks have exposure to commercial real estate greater than 300% of their total equity, as reported in their first quarter 2024 regulatory data and shown by the U.S. Banks’ Exposure to Risk from Commercial Real Estate screener.

This is a very serious development for our banking system as commercial real estate loans are repricing in a high interest-rate environment,” said Rebel Cole, Ph.D., Lynn Eminent Scholar Chaired Professor of Finance in FAU’s College of Business.

“With commercial properties selling at serious discounts in the current market, banks eventually are going to be forced by regulators to write down those exposures.”

Though the Big Banks don’t have as much risk as the regionals, they’re not completely insulated.

Here’s Bloomberg from back in May:

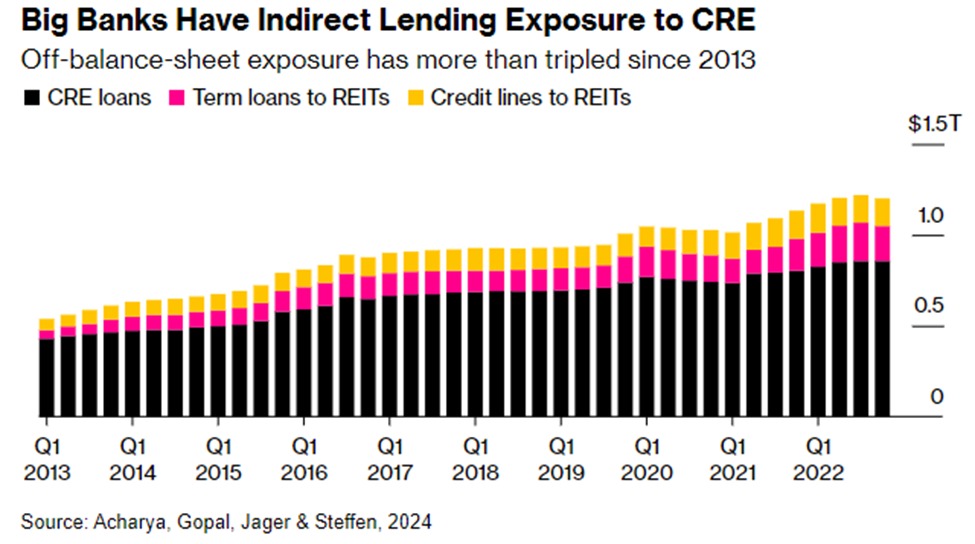

Large US banks may be more exposed to commercial property than regulators appreciate because of credit lines and term loans they provide to real estate investment trusts, according to a new study.

Big banks’ exposure to CRE lending grows by about 40% when that indirect lending to REITs is added, wrote researchers including Viral Acharya, a professor of economics at New York University. That’s largely been missed in the debate about the risks the troubled industry poses to lenders, they argue.

Below is a chart showing the added exposure that Big Banks have to real estate when we factor in indirect REIT lending.

The black columns represent traditional CRE loans. The pink and yellow columns show us term loans and credit lines to REITs.

Source: Acharya, Gopal, Jager & Steffen, Bloomberg

Even Federal Reserve Chairman Jerome Powell suggests the problem “will be with us for some time”

From Powell, speaking before the U.S. Senate Banking and Housing Committee last month:

This is a risk that has been with us and will be with us for some time – probably for years.

Banks need to be honestly assessing what their risk is. They need to be assured that they have the capital, liquidity, and systems in place to manage this risk…

The large banks can manage this problem. Most small banks can too, but it is in some smaller banks that tend to have that local concentration in commercial real estate…

It’s going to be an issue for many banks. But it’s one that we’re trying to work through, one that we’re very much aware of.

Again, it will be with us for some time.

Will “extend and pretend” be enough to keep the sector afloat until the Fed saves the day with interest rate cuts?

“Extend and pretend” is the real estate practice wherein borrowers ask for extensions on the maturity dates of their loans to avoid recognizing a loss.

We’ve seen a lot of this over the last year as borrowers have frantically attempted to kick the can down the road, holding out for rate cuts from the Fed.

You see, many of the fixed-rate loans originated before 2022 have interest rates in the 3–5% range. To refinance today, borrowers are looking at rates closer to 6.5–10%.

It’s no wonder that the real estate sector is anxiously awaiting interest rate cuts. The key question is “will the Fed cut rates enough – and fast enough – to prevent a wipeout?”

Why the Fed’s current projection for interest rate cuts may not be enough

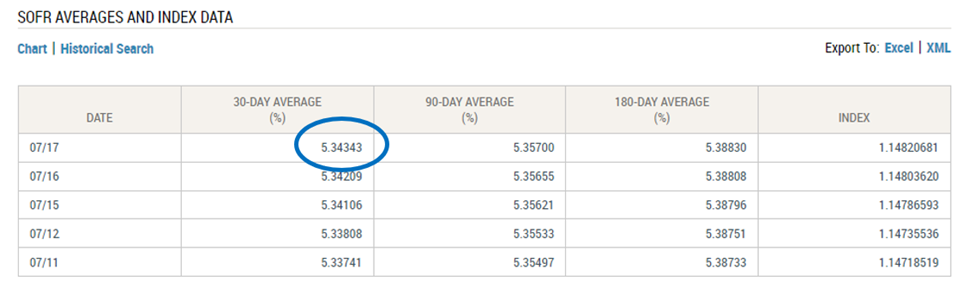

When it comes to refinancing commercial real estate, the Secured Overnight Financing Rate (SOFR) is very important.

The one-month SOFR is the standard index rate used for floating rate commercial real estate loans.

As of yesterday, the one-month SOFR sits at 5.34% as you can see below in data from the Federal Reserve Bank of New York.

Source: Federal Reserve data

Now, according to the Forward Curve (the market’s projection of the SOFR based on SOFR Futures contracts), the SOFR is projected to drop substantially over the next 18 months.

In fact, as of January 2026, the one-month SOFR is expected to come in at 3.54%. This projection reflects what we’ve heard from the Fed about rate cuts over the next 18 months.

But will this lower SOFR rate save the day?

It’s unlikely.

Commercial real estate loans featuring a floating rate are priced based on an index rate (like the one-month SOFR) plus some additional spread

Usually, the size of this spread ranges between 250 and 400 basis points.

So, even if the Fed cuts rates as the market currently anticipates, we’re still looking at a refi rate somewhere between roughly 6.04% and 7.54% at the beginning of 2026.

Let’s circle back to the chart we showed earlier – you’ll recall this enormous red spike of debt coming due in 2026…

Source: Federal Reserve data / WSJ

Now, consider that many of these loans originated in years during which the one-month SOFR was practically 0%, meaning that the all-in interest rate was somewhere between 2.50 – 4.00%.

This means a potential refi in 2026 will be between 50% and 200% more expensive – even after rate cuts as they’re currently projected.

Oh, and don’t forget how tenants are fleeing these buildings, resulting in lower rental rate revenues. Exploding refi rates and eroding rental revenue is not a great combo.

An awareness of these numbers helps explain why one real estate analyst I read recently suggested that yesterday’s rallying cry of “Survive ‘til ’25,” needs a rewrite to “Don’t deep-six in ’26.”

What’s the action step?

Take inventory of your portfolio’s exposure to commercial real estate.

This includes obvious exposure such as commercial REITs and regional banks, but also less obvious exposure like private equity companies (think Blackstone) and insurance companies (think MetLife and Principal Financial Group).

Keep in mind, your risk as an investor isn’t limited to a default. If a stressed company is forced to slash a dividend payment to shore up operational weakness, that’s likely to cause some investors to race for the door, which could leave you sitting on a substantial drawdown (not to mention that reduced dividend).

To avoid this scenario, keep your eye on the payout ratio of your holdings.

In general, a payout ratio between 35% and 60% is deemed safe from dividend cuts. Ratios between 60% and 75% are somewhat safe. But payout ratios above 75% are considered at risk.

Now, the flip side is that we’ll likely see some fantastic buying opportunities in the coming quarters. But we’ll be buying from burned real estate investors who rode the sector into the ashes.

Make sure that’s not you.

Have a good evening,

Jeff Remsburg

More From InvestorPlace

The post The Commercial Real Estate Meltdown is Spreading appeared first on InvestorPlace.