Miami Creative Flex Building Investment Opportunity: Rail 71

As Miami’s urban landscape continues to evolve, Little River has emerged as one of the city’s most dynamic submarkets, offering a compelling blend of creative energy and investment potential. Rail 71 stands at the forefront of this transformation – a 127,562 SF creative flex building that exemplifies the neighborhood’s industrial heritage while capturing its creative future. Recently reimagined in 2024, this strategic asset presents investors with a rare opportunity to acquire a significant position in Miami’s expanding creative corridor.

Key Investment Highlights for Rail 71 in Miami’s Creative Corridor

Rail 71, a Miami creative flex building for sale, offers a rare opportunity for investors to acquire a property blending modern design with strong income potential.

- Prime Location: Strategically positioned at 7205 NE 4th Avenue, Miami, FL 33138, Rail 71 benefits from its proximity to Miami’s established creative districts while offering more attractive economics for tenants and investors alike.

- Building Specifications: 127,562 SF total (122,318 RSF) situated on a generous 3.69-acre site, providing scale rarely available in Miami’s urban core.

- Compelling Pricing: Offered at $42,500,000 ($333/SF), representing an attractive basis relative to replacement cost and comparable sales in adjacent submarkets.

- Strong Occupancy: Currently 89.3% occupied, demonstrating the property’s appeal while maintaining the upside through lease-up of remaining vacancy.

- Projected Returns: The investment presents a compelling financial profile:

- Year 1 NOI: $2,521,108

- Year 1 Cap Rate: 5.93%

- Stabilized NOI: $3,853,348

- Stabilized Cap Rate: 9.07%

- 10-Year CAGR: 8.09%

Miami Creative Flex Building for Sale: Rail 71 Property Overview

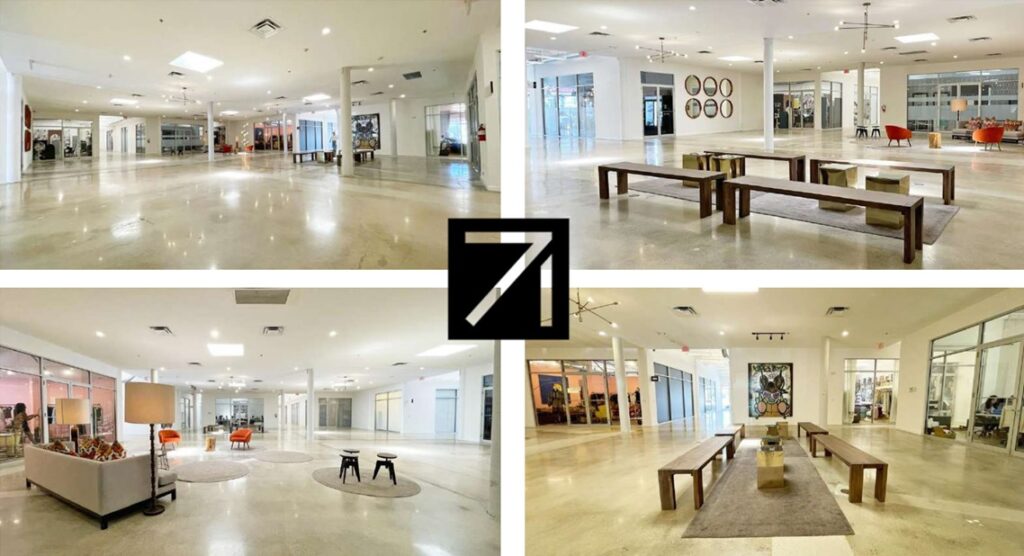

Rail 71’s recent transformation has created a distinctive creative environment that resonates with Miami’s evolving tenant base:

- Modern Design: A contemporary facade featuring black and white design elements and prominent RAIL71 branding, blending industrial heritage with modern aesthetics.

- Premium Common Areas: Double-height spaces with gallery-style lighting, curated art installations, and designer furnishings create an elevated tenant experience.

- Class A Amenities: Recently renovated facilities including modern bathrooms, collaborative spaces, and high-end finishes throughout.

- Flexible Space: Engineered floor plans that adapt to diverse tenant needs, from creative offices to showrooms.

- Professional Operations: Full-service property management and ample parking support a variety of business uses.

- Enhanced Grounds: Professionally landscaped exterior featuring mature palm trees and modern hardscaping creates an inviting atmosphere.

Rail 71 Location Advantages: Strategic Miami Creative Corridor Property

Rail 71’s strategic position in Miami’s evolving creative corridor offers multiple location benefits:

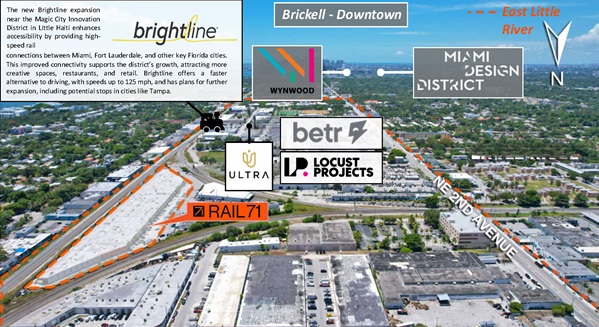

- Prime Miami Position: Located at 7205 NE 4th Avenue in Little River, Miami, FL 33138. Just 10 minutes from Downtown Miami, 15 minutes from Miami International Airport, and 12 minutes from Miami Beach.

- Creative District Access: Minutes from the Miami Design District and Wynwood Arts District. Situated along the North Miami Avenue corridor, connecting Miami’s established arts and culture hubs.

- Transit Connectivity: Walking distance to the upcoming Brightline Miami station, offering rapid connections to Fort Lauderdale and West Palm Beach. Easy access to I-95, Biscayne Boulevard, and Miami’s major transit arteries.

- Cultural Ecosystem: Anchored within Little River’s thriving gallery district, alongside Markowicz Gallery, N’Namdi Contemporary, Dot Fiftyone Gallery, and Emerson Dorsch. Integrated into a creative community including BETR, Ultra, and Locust Projects.

- Neighborhood Amenities: Walking distance to The Citadel, ZeyZey, and acclaimed restaurants including Tran An. Minutes from Legion Park Farmers Market and emerging retail destinations.

- Market Strength: Limited supply of comparable renovated flex space, with recent sales averaging $373.6/SF. Strong leasing momentum shows monthly absorption of 12,009 SF, average lease size of 3,603 SF, and consistent velocity of 3.33 deals per month.

- Growth Trajectory: Positioned along the natural expansion path between established districts, with robust demographic trends driving continued neighborhood evolution.

Market Opportunity for Creative Flex Building in Little River, Miami

As a Miami creative flex building for sale, Rail 71 stands out in the competitive market due to its adaptability, prime location, and below-market rents. Multiple growth drivers strengthen Rail 71’s value proposition. Below-market rents offer clear potential for growth, backed by strong market performance. The area shows healthy demand, absorbing 72,052 SF with lease rates from $20-60/SF and averaging 3.33 new deals per month.

Rail 71’s location offers high visibility in Little River along NE 4th Avenue, sitting in a prime growth corridor between the Design District and Upper Eastside. As creative businesses seek authentic, adaptable spaces, and with limited similar properties available, Rail 71 stands out as an attractive alternative to Miami’s higher-priced districts.

Rail 71 Investment Rationale: Prime Miami Office and Flex Space

Rail 71 presents a compelling investment thesis supported by multiple value drivers:

- Value-Add Component: The property’s current below-market rents offer immediate upside through strategic lease-up and renewal initiatives. With 89.3% occupancy, the asset provides stable income while maintaining clear opportunities for value creation through vacancy lease-up and mark-to-market adjustments.

- Strategic Location: Positioned to benefit from Miami’s expanding creative corridor and spillover demand from established submarkets. The property’s location within the larger Rail71 development, combined with its direct access to the NE 2nd Avenue corridor, places it squarely in Little River’s path of growth.

- Strong Cash Flow: Stable in-place income combined with multiple vectors for NOI growth. The property’s demonstrated leasing velocity, with the submarket averaging 3.33 deals per month and total absorption of 72,052 SF, supports strong ongoing cash flow potential.

- Market Dynamics: Benefits from the continued evolution of Miami’s creative office and flex sectors. The property’s position between the Design District and Upper Eastside captures natural market expansion, while limited competitive supply in the immediate area supports strong market fundamentals.

- Quality Improvements: Recent capital improvements reduce near-term capital requirements while enhancing marketability. Comprehensive renovations including modernized common areas, updated building systems, and contemporary facade improvements position the asset to compete effectively for creative tenants seeking authentic, adaptable space.

Next Steps for Investing in Rail 71: Miami’s Premier Creative Space

We invite qualified investors to contact us immediately to begin the review process. Given the property’s strategic location and value-add potential, we anticipate strong interest from both institutional and private capital sources.

To receive the offering memorandum and schedule a property tour, contact:

DWNTWN Realty Advisors

Tony Arellano P.A.

Managing Partner

(C) 786.333.7199

(O) 786.235.8330

[email protected]

Devlin Marinoff

Managing Partner & Broker

(C) 917.312.2219

(O) 305.909.7343

[email protected]

Rail 71 represents a rare opportunity to acquire scale in Miami’s emerging creative corridor. Don’t miss this chance to participate in Little River’s continued transformation. Contact us today to begin your investment review process.