In a significant move that underscores the vibrant growth of Miami’s Wynwood district, DWNTWN Realty Advisors has successfully brokered a $12.3 million commercial real estate deal. This case study explores the intricacies of the transaction, highlighting the expertise and market insight that DWNTWN Realty Advisors brought to the table in facilitating this high-profile deal in one of Miami’s most dynamic neighborhoods.

Wynwood NNN Properties Project Overview

- Location:

- 282-292 NW 25th Street, Miami, FL 33127

- 325-339 NW 24th Street, Miami, FL 33127

- Transaction Date: September 16, 2024

- Deal Value: $12.3 million (Note: The original asking price was $14.9 million)

- Property Type: NNN Wynwood Retail Portfolio

- Total Building Size: 19,760 SF

- Total Lot Size: 22,719 SF (0.52 acres)

- Price per SF (Building): $622 (based on the final sale price)

- Price per SF (Land): $541 (based on the final sale price)

- Occupancy: 100%

- Number of Tenants: 2

- Buyer: Zach Vella

- Seller: East End Capital

- Brokerage: DWNTWN Realty Advisors, LLC (representing both parties)

Understanding the Wynwood Miami Investment Opportunity

The sale of this Wynwood portfolio represents a pivotal moment in the neighborhood’s ongoing transformation. The portfolio consists of four buildings with cross-block double frontage on NW 24th Street and NW 25th Street, offering a unique opportunity in Wynwood’s core pedestrian district.

Key aspects of the deal include:

- Value-Add Opportunity: With the DogFish Head brewery’s lease ending in November 2023, there’s potential to lease to another user at market rents or renovate the space.

- Development Potential: The site possesses remaining development TDRs for 23 residential units and full office, or 26 hotel keys, before available bonuses or market transfers.

- Strategic Location: The portfolio is ideally situated next to Wynwood 25 on 25th Street, surrounded by some of the best retail Wynwood has to offer.

Client Expertise and Role in the Commercial Property Negotiation

DWNTWN Realty Advisors leveraged its deep understanding of Miami’s commercial real estate market, particularly in the Wynwood area, to facilitate this transaction. The firm’s expertise in:

- Market analysis and valuation

- Negotiation strategies

- Due diligence processes

- Transaction structuring

allowed them to navigate the complexities of representing both parties while ensuring a favorable outcome for all involved.

Benefits of the Miami Urban Core Development Transaction

- Market Positioning: The acquisition strengthens the buyer’s portfolio in the highly sought-after Wynwood neighborhood.

- Investment Potential: The property’s location and remaining development rights suggest strong potential for appreciation and future development opportunities.

- Strategic Exit: For the seller, East End Capital, the transaction represents a successful exit strategy, capitalizing on Wynwood’s rising property values.

- Economic Impact: The deal contributes to the ongoing economic growth and development of the Wynwood area.

- Value-Add Opportunity: The potential to reposition the DogFish Head brewery space offers significant upside in rent growth.

Miami Retail Space Property Details

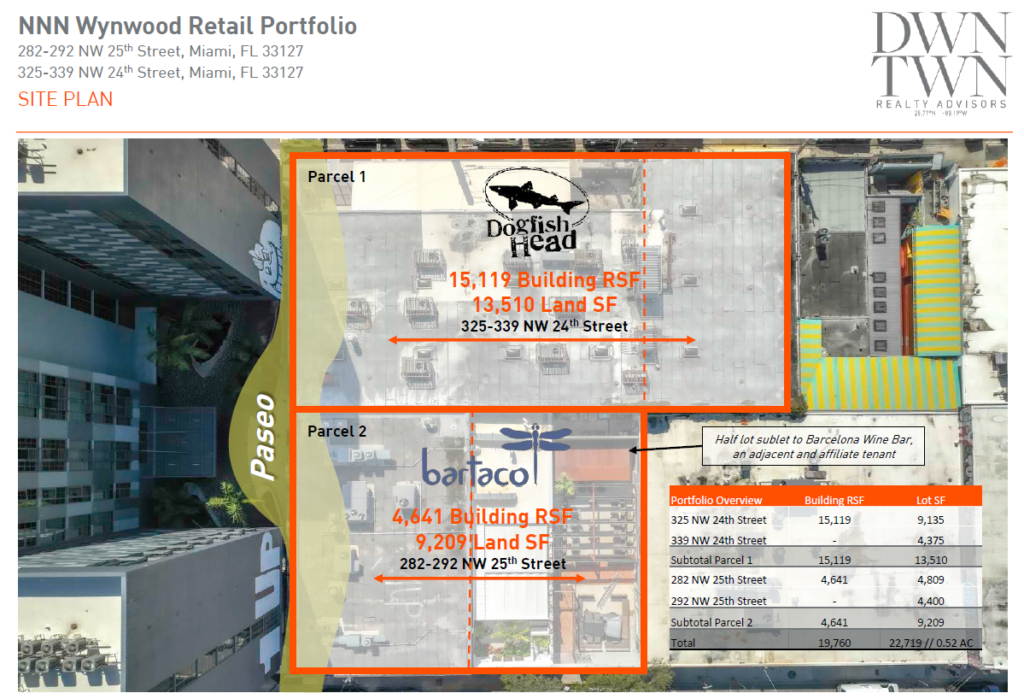

The portfolio is composed of two parcels:

- Parcel 1 (325-339 NW 24th Street):

- Building Size: 15,119 SF

- Lot Size: 13,510 SF

- Parcel 2 (282-292 NW 25th Street):

- Building Size: 4,641 SF

- Lot Size: 9,209 SF

Current tenants include Bartaco and DogFish Head brewery, with Barcelona Wine Bar subletting half of the 292 NW 25th Street lot.

Financial Highlights

- In-Place Cap Rate: 3.66%

- Pro-Forma Stabilized Cap Rate: 9.7%

- Pro-Forma NNN Rent: $75 NNN

Wynwood: A Neighborhood in Transformation

Wynwood has undergone a remarkable metamorphosis, shedding its industrial cocoon to emerge as Miami’s vibrant epicenter of creativity, technology, and urban culture. This former warehouse district has reimagined itself, blending its gritty past with a colorful present to create a unique tapestry of art, innovation, and community. Key aspects of Wynwood’s transformation include:

- The opening of the Wynwood Walls in 2009, which catalyzed the neighborhood’s artistic renaissance

- The Neighborhood Revitalization District-1 (NRD-1) rezoning plan in 2015, which paved the way for mixed-use development while preserving the area’s distinctive character

- The influx of tech companies like Blockchain.com, OpenStores, and Founders Fund, earning Wynwood the moniker “Silicon Valley of the South”

- The proliferation of eclectic dining venues, innovative galleries, and innovative residential projects that cater to a diverse, forward-thinking demographic

Implications for Miami’s Commercial Real Estate Market

This transaction has several implications for Miami’s broader commercial real estate market:

- It reinforces Wynwood’s status as a prime investment destination.

- It demonstrates the potential for value creation in transforming industrial areas.

- It highlights the importance of local market expertise in facilitating complex deals.

- It suggests continued investor confidence in Miami’s urban core neighborhoods.

The successful brokerage of this $12.3 million Wynwood portfolio deal by DWNTWN Realty Advisors underscores the firm’s position as a leader in Miami’s commercial real estate market. By leveraging their deep market knowledge, extensive network, and strategic approach, DWNTWN Realty Advisors was able to facilitate a win-win transaction for both buyer and seller.

As Wynwood continues to evolve and attract investment, deals like this one will play a crucial role in shaping the neighborhood’s future. For investors and property owners looking to navigate Miami’s dynamic commercial real estate landscape, partnering with experienced firms like DWNTWN Realty Advisors can be key to achieving successful outcomes.

Are you looking to buy, sell, or invest in Miami’s dynamic commercial real estate market? Let DWNTWN Realty Advisors guide you through your next transaction with the same expertise and dedication demonstrated in this Wynwood portfolio deal.

Contact DWNTWN Realty Advisors today.