Bob Knakal, the veteran sales broker who has arranged more than $20B in New York City commercial real estate deals, is back with a new venture.

Knakal launched BK Real Estate Advisors on Tuesday, a brokerage that he says will merge his business of investment sales, debt and equity with the new frontier of artificial intelligence.

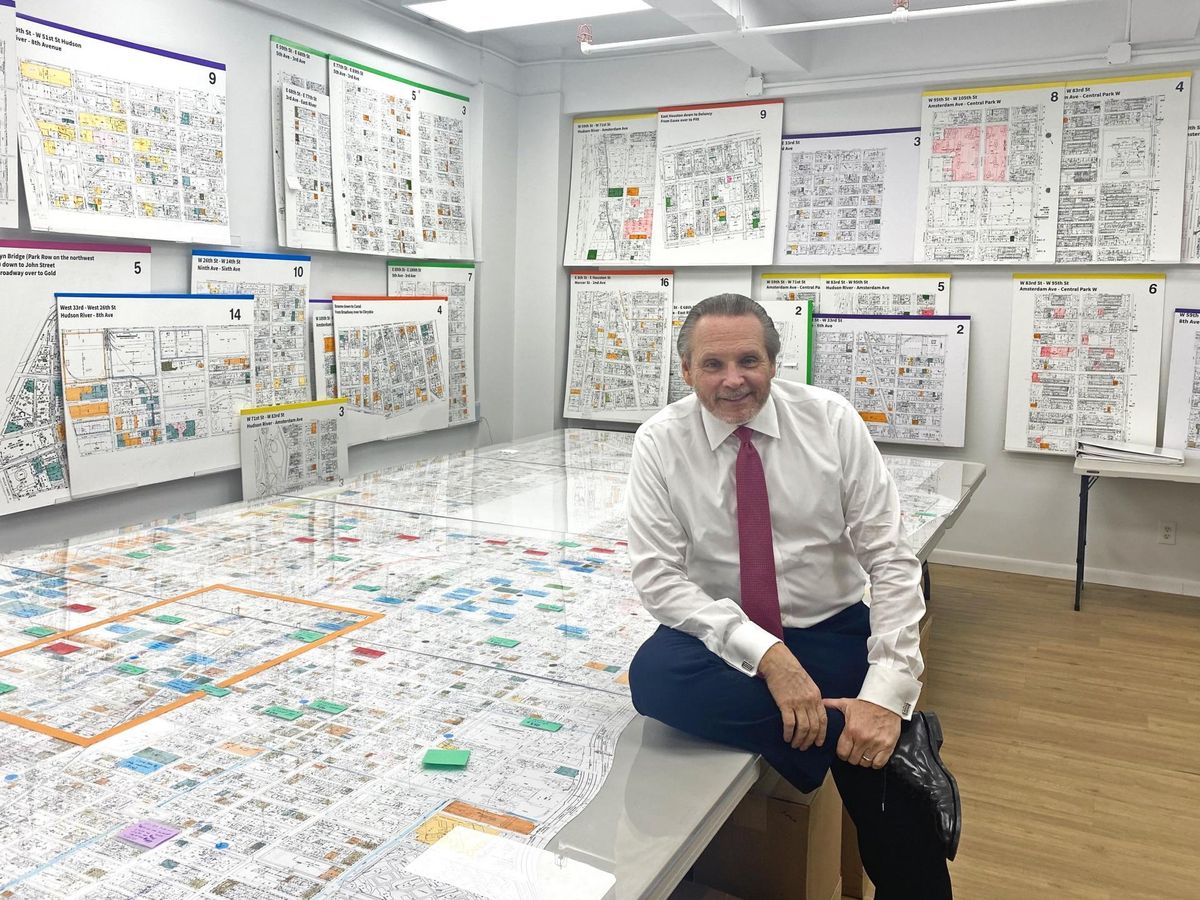

Bisnow/Sasha Jones

Bob Knakal in the Map Room at an undisclosed location in Manhattan.

“I’m starting my own company,” Knakal told Bisnow in an interview in his famed Map Room last week. “And this stems from the fact that the world is changing so much.”

Knakal has hired Seth Samowitz, who boasts an AI background and has worked at tech companies Uber and Square, as his chief operating officer. The team consists of seven people, which Knakal plans to grow to between 15 and 20.

He has had his eye on developments in the AI space as it has rapidly matured, just as many in the industry will have their eye on his new firm after his abrupt departure from JLL in February.

Knakal was let go from the firm, which he joined in 2018, following the publication of a New York Times article that highlighted Knakal’s Map Room, which details every block of Manhattan and which properties are for sale. But it mentioned JLL just once toward the end.

“At JLL the client comes first, JLL comes second and the individuals come third,” JLL New York Region President Peter Riguardi told The Real Deal in a statement when the news broke that Knakal had been ousted.

Looking back, Knakal admitted that the Times article likely put him “in hot water.” But he said he didn’t regret it because it was good for his market presence, shined a light on his analytical nature and let clients know he’s an active deal-maker.

“For the most part, except for the big institutional clients, people hire people. They don’t hire companies,” Knakal said. “I will bet that 30% to 40% of my client base didn’t even know what company I worked at — or cared.”

The 61-year-old, who has sold more than 2,300 properties totaling $22B, has experienced swift exits before.

He launched investment sales firm Massey Knakal in 1988 with Paul Massey, the former mayoral candidate who founded and runs B6 Real Estate Advisors, then sold it to Cushman & Wakefield for $100M in 2014. At the time, Massey Knakal had more than 200 employees and an annual gross revenue of about $80M.

In 2018, Knakal split from Cushman & Wakefield four days prior to his contract expiration date. Shortly after, he found a new home at JLL, where he headed its New York City private capital group for nearly six years.

“I’ve been nine and a half years at the big global firms, and from just about the minute I departed from JLL, the entrepreneurial spirit became reawakened,” he said.

Exciting News from the Knakal Map Room

Bob Knakal here, and I’m thrilled to share some exciting news about my latest venture. After a period of reflection and immense support from this incredible community, I’m proud to announce the launch of @BKRealEstateAdv (BKREA).

BKREA… pic.twitter.com/t7TmkJrOcz

— Bob Knakal | NYC Investment Sales (@BobKnakal) April 2, 2024

He already carved out his own space by renting a Midtown office for the Map Room during the pandemic. And about eight months ago, he said he began meeting weekly with Rod Santomassimo, president of real estate consulting firm the Massimo Group.

In those sessions, he began training on how to incorporate AI into his work. At the same time, he was working with two data scientists to use new technology to examine and predict land and property values.

Those kinds of calculations will be paired with his Knakal Land Index, an analysis of sales data from 1984 to the present. The comprehensive study will allow sellers to make AI-informed predictions while working with BKREA, he said.

Knakal said he also plans to digitize and expand his Map Room to each of the boroughs, with the exception of Staten Island. Doing so through the use of mapping technology will be quite different from how the project originated.

In 2020, Knakal and his team wandered the streets of Manhattan for a total of 220 hours, documenting each lot — and discovering which are underutilized. Knakal said access to such information will be a differentiator for his firm.

“We’re in the business of helping our clients make the best decisions and getting them the best price on the best terms,” Knakal said. “We think that having all of this information will ultimately be a great advantage to the client.”

The tech will also allow him to work smarter and faster.

Knakal frequently speaks on the importance of cold calling and making appearances in the industry — he has a goal of attending 261 networking events a year — and said that AI could leave clients ringless, personalized voice messages.

“You have 250,000 people that own investment property in New York City,” Knakal said. “I’m a very good cold caller. I can’t cold-call that many people in 10 years.

“AI can help funnel that down to the folks who say they want to transact,” he added.

He said he plans to grow his social media presence after only becoming active last January. And he still won’t shy away from talking to the press.

“Some people could look at it and say, ‘Oh, well, Knakal is just being a media hog.’ That’s not it at all. It’s about finding any way possible to help a client get the best possible result,” Knakal said. “I don’t really care how [a client] got to me. All I know is they got to me, and if an ad can potentially help one of my clients, of course I’m going to keep doing it.”