Manhattan land is not a normal market. Scarcity drives the pricing and competition drives the pace. Developers often “find land” by targeting older, underutilized buildings that later become development sites.

BK Real Estate Advisors (BKREA) announced the Knakal Land Index, a 41-year study of Manhattan land sales dating back to 1984.

It spans 41 years of Manhattan land sales, segments transactions by property type, and compares land value swings against macroeconomic factors using proprietary AI models.

Bob Knakal, Chairman and CEO of BKREA, said the firm views itself as being in the “information and relationship business,” and that informed decisions lead to better outcomes.

Key stats: Knakal Land Index at a glance

Key stats: Knakal Land Index at a glance

- 41 years of data

- 2,444 transactions

- Prime Manhattan geography

- Five property-type buckets

Knakal Land Index scope: prime Manhattan geography

The Knakal Land Index focuses on prime Manhattan, defined as:

- South of 96th Street on the East Side

- South of 110th Street on the West Side

This is the corridor where redevelopment competition is most intense, and pricing tends to reflect high-stakes density bets.

With Manhattan’s skyline constantly changing, the index tracks the land sales market where developers’ decisions shape what gets built next.

What’s in the Knakal Land Dataset?

The dataset covers 2,444 sale transactions, disaggregated into five property-type categories:

- Residential rental

- Residential condo

- Office

- Hotel

- Miscellaneous (mostly education and healthcare)

This breakdown is a key point. Land pricing does not behave identically across uses, and lumping everything into one blended “Manhattan land” number can flatten what investors actually need to understand.

How the Analysis Works

The index compares land value fluctuations against a wide array of macroeconomic factors using proprietary AI models to identify which factor, or combination of factors, has been most predictive of future changes in direction and the potential magnitude of those changes.

That framework is designed to make the dataset usable, not just historical.

Methodology: consistent since 1984

Methodology: consistent since 1984

Knakal has used an identical methodology for calculating the data since 1984.

That consistency supports cleaner comparisons across cycles without shifting the rules midstream.

If the methodology truly stays consistent, it can become a baseline reference that market participants return to instead of reacting to short-term headlines.

Why Manhattan “land” is hard to spot

Manhattan doesn’t create land in the traditional sense. New development opportunity often comes from demolishing older, underutilized properties to make way for new construction, so the best sites are not always obvious.

In other words, the “land market” can show up inside what looks like a building trade.

Knakal is widely recognized as a top development site broker in New York City, in part for his ability to spot overlooked opportunities and maximize site value by increasing buildable density through multiple mechanisms.

That’s why a land sales dataset is relevant beyond developers. It can inform how lenders, investors, and owners think about redevelopment optionality and the pricing of density.

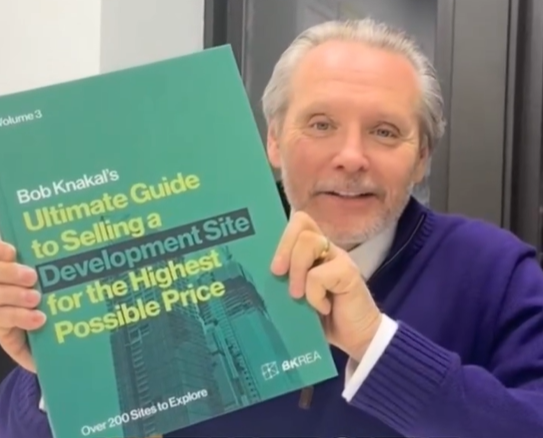

Where the findings live: the Ultimate Guide to Selling a NYC Development Site

A summary of the index’s findings appears in Knakal’s Ultimate Guide to Selling a Development Site for the Highest Possible Price, a 340-page coffee table book published by BKREA.

The book includes:

- A comprehensive overview of Manhattan land sales history

- The index findings

- Over 200 development sites Knakal has sold, each with a deal write-up, sale price, and client testimonial

- Before-and-after visuals showing how NYC has evolved

- A summary of Knakal’s nominations for the REBNY Most Ingenious Deal of the Year Award, and that he has won twice

Industry reaction

Robert Lobel, president of Bellrock Development, called the index an “old-school piece of research” that lets the market “go under the hood,” and said it’s rare to see four decades of research with this level of depth.

Knakal also said the research is not available anywhere else and is intended to give BKREA clients a significant advantage.

BKREA background and track record

BKREA is a New York City investment sales brokerage focused on development, redevelopment, and user buildings and is owned by Bob Knakal. The firm states Knakal has sold more than 2,388 NYC properties with an approximate market value of $24 billion.

Takeaway

BKREA’s Knakal Land Index compiles 41 years of prime Manhattan land sales into a dataset segmented by property type and paired with a macro-factor analysis framework. The value is simple: it gives the market a clearer factual baseline for how Manhattan land pricing has behaved across cycles.