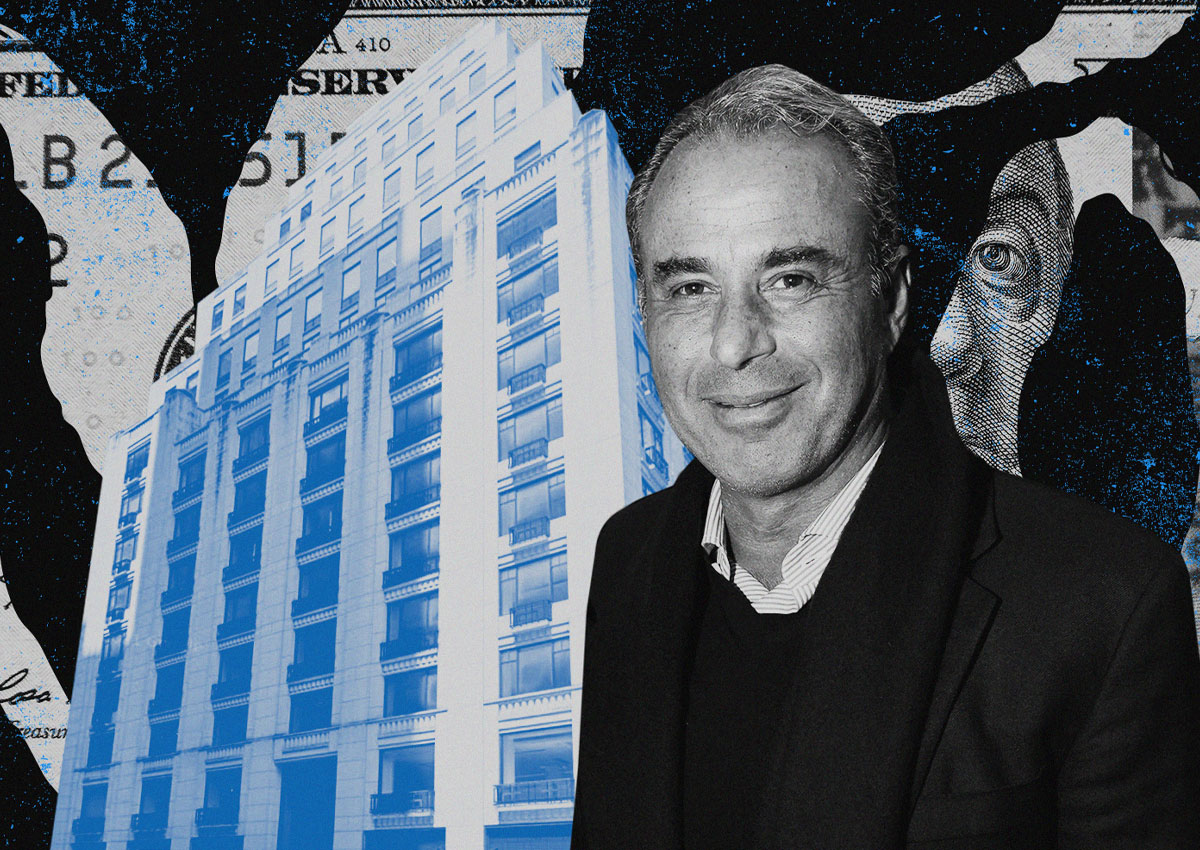

If you’re wondering why Ben Ashkenazy’s 660 Madison Avenue, site of the former Barneys New York flagship, remains vacant, you’re not alone. Apparently Ashkenazy’s co-investors in the property have wondered the same thing.

The billionaire head of Ashkenazy Acquisition addressed the issue in a rare public interview at The Real Deal’s New York Forum in May, but his comments, some of which appeared in a TRD story the next day, stayed under the radar.

I was in the audience that day and jotted some quotes down to supplement those reported by Elizabeth Cryan.

“Barneys is the best piece of real estate on Madison Avenue,” Ashkenazy said. “I’ve chosen to keep it vacant for a reason, because one big retailer is going to buy it.”

Perhaps that will work out in the end, but for now, it means Ashkenazy’s co-owners at 660 Madison have been getting virtually no return from a building worth hundreds of millions of dollars.

Meanwhile, Jeff Sutton has in the past seven months sold retail space at 715-717 Fifth Avenue to Kering for $963 million and 720 and 724 Fifth Avenue to Prada’s parent for a combined $835 million.

When Ashkenazy referred to his investors’ queries about the property, I got the sense that some were getting antsy. Carving the site up into smaller retail spaces and offices would make it available to a larger pool of buyers and tenants. But Ashkenazy told them that would be a bad idea.

“I said, ‘Guys, sit tight. We don’t need to do anything. One guy is going to buy the whole property and he’s going to pay $1 billion for it.’”

Way back in 2001, Ashkenazy paid $135 million for the 10-story retail portion of the 22-story, 275,000-square-foot building. Barneys closed its doors in 2020, a year after filing for bankruptcy as Ashkenazy doubled its rent to $30 million a year. Other than a Louis Vuitton pop-up exhibit in late 2022, not much has happened at 660 Madison since.

Ashkenazy, though, said big brands covet such spaces.

“Right, now there’s a surge of them trying to compete with one another by trying to control their own destiny by controlling their own store and they’re fighting amongst themselves for the best corners,” Ashkenazy said at our event. “That corner’s extremely important.”

One post reported that luxury-brand conglomerate LVMH thought about acquiring 660 Madison for its first Manhattan Cheval Blanc, but decided the hotel wouldn’t have enough rooms with views of Central Park. Rumors then surfaced that Chanel informally offered $1 billion, contingent on some Upper East Side deals. Nothing came of that either.

Ashkenazy might eventually be proven right, and we tend to give the benefit of the doubt to people who have made a fortune in real estate, as Ashkenazy has. But even billionaires are occasionally wrong, and some of Ashkenazy’s investments have certainly run into trouble lately.

Read more

Ben Ashkenazy goes on the offensive

Ashkenazy gets go-ahead to double the rent at Barneys’ Madison Avenue flagship