Email Sign Up For Our Free Weekly Newsletter

Based on new data from CBRE, the U.S. commercial real estate lending market slowed in Q1 2024 due to high interest rates and limited credit availability, but a tightening of credit spreads indicated signs of stabilizing.

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., decreased by 11% from Q4 2023. The index saw a decline of 32.7% compared with the strong loan volume of Q1 2023. The index closed Q1 2024 at a value of 168.

Credit spreads between the 10-year Treasury yield and seven-to-10-year fixed-rate permanent commercial loans with loan-to-value ratios of 55% to 65%, tightened by 22 basis points (bps) quarter-over-quarter to 212. Multifamily spreads also tightened by 17 bps to 175.

“While the commercial real estate lending market experienced a slowdown in the first quarter, this was primarily influenced by market conditions in the third and fourth quarters of 2023; looking forward, we are seeing an uptick in activity, particularly driven by institutional investors seeking to recycle capital, with a notable increase in BOV (broker opinion of value) activity and financings over $100 million. CBRE’s lending volume in Q1 2024 increased compared to the same period in 2023,” said James Millon, U.S. President of Debt & Structured Finance for CBRE.

“With investment sales down, we are seeing a shift towards hard maturity refinancings, construction loans, and bridge lending, which is expected to continue until there is consensus on rate cuts. While commercial banks are reducing their presence in the market, the combination of agency, life companies, CMBS, and debt funds continues to support credit availability. Credit spreads remain favorable, but the challenge lies in securing accretive financings on core assets due to higher benchmarks.”

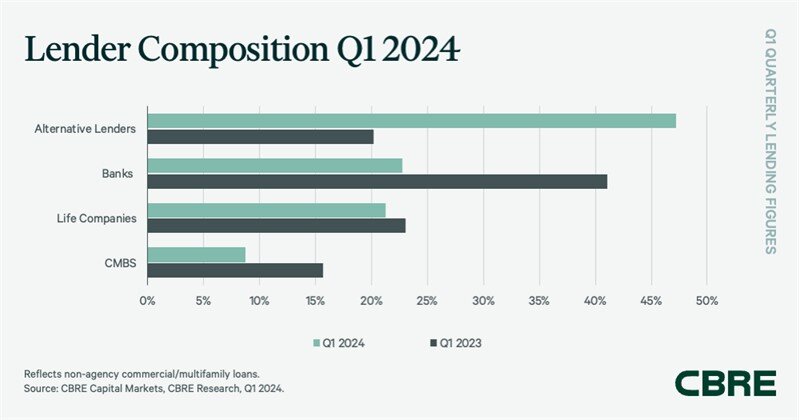

Alternative lenders, such as debt funds and mortgage REITs, emerged as the leading contributors to CBRE’s non-agency loan closings, accounting for 47.2% of the total in Q1 2024. This represents a significant increase from their 20.2% share a year earlier, driven primarily by bridge lending. Collateralized loan obligations (CLO) increased to $1.5 billion in Q1 2024, up from $700 million in the previous quarter.

Banks were the next most active lending group with 22.7% of non-agency loan closings in Q1 2024, down from their 41.1% share a year earlier. Banks are expected to remain cautious due to the increase in loan extensions, limited liquidity and the potential for increased regulatory pressures.

Life insurance companies contributed 21.3% of origination volume in Q1 2024, down from 23.1% a year earlier. While still active, life insurance companies are expected to adopt a more selective approach this year.

CMBS conduits represented the remaining 8.8% of origination volume in Q1 2024, declining from 15.7% a year earlier.

In Q1 2024, there were slight changes to underwriting criteria. Average underwritten cap rates and debt yields stabilized at 6% and 9.8%, respectively. The average LTV ratio increased by 80 bps to 62.3%. Higher interest rates translated to loan constants averaging 6.92% in Q1 2024, representing a 50 bps decline from Q4 2024.

Government agency lending on multifamily assets decreased to $19.2 billion in Q1 2024, down from $27.1 billion in Q4 2023. CBRE’s Agency Pricing Index, reflecting average fixed agency mortgage rates on 7-10-year permanent loans, fell by 32 bps in Q1 2024 but rose by 40 bps year-over-year to 5.72%.