On November 2, 2023, Jeffrey Nager, the Executive Vice President and Head of Commercial Lending at The Bancorp Inc (NASDAQ:TBBK), sold 5,234 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

The Bancorp Inc, a financial holding company, provides a range of commercial and retail banking services. The company operates through two segments, Specialty Finance and Community Banking. It offers a suite of deposit and loan products. The company also provides private label banking; credit and debit card payment processing for independent service organizations; institutional banking; and internet banking services.

Over the past year, the insider has sold a total of 5,234 shares and purchased 0 shares. This trend of selling without any purchases raises questions about the insider’s confidence in the company’s future performance.

Insider Sell: EVP Head of Commercial Lending Jeffrey Nager Sells 5,234 Shares of The Bancorp Inc

The insider transaction history for The Bancorp Inc shows a total of 7 insider buys and 9 insider sells over the past year. This trend suggests a mixed sentiment among the company’s insiders, with more sells than buys.

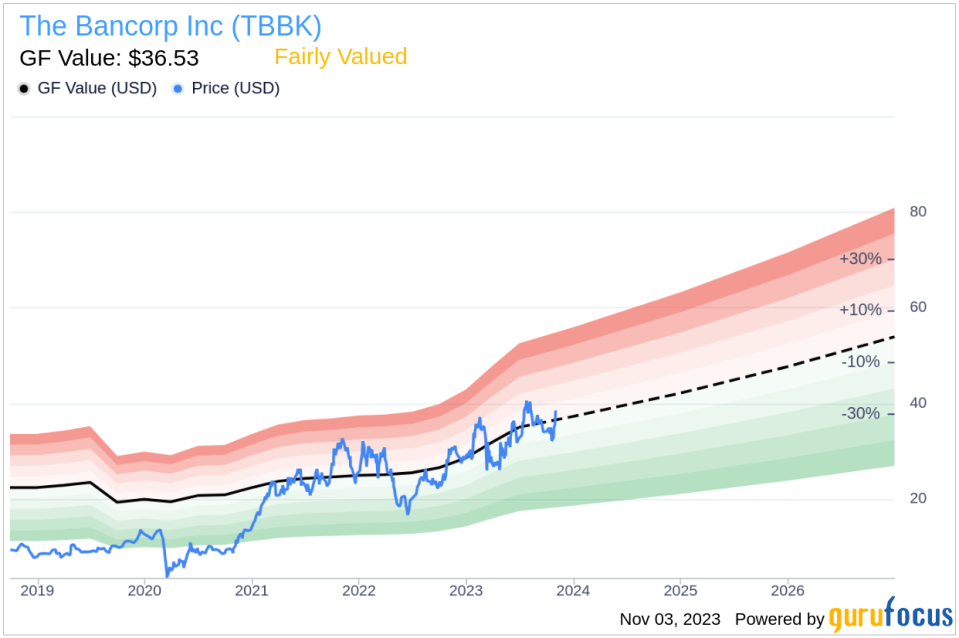

On the day of the insider’s recent sell, shares of The Bancorp Inc were trading for $38.26 apiece, giving the stock a market cap of $2.076 billion. The price-earnings ratio is 11.34, which is higher than the industry median of 8.24 but lower than the companys historical median price-earnings ratio.

Insider Sell: EVP Head of Commercial Lending Jeffrey Nager Sells 5,234 Shares of The Bancorp Inc

With a price of $38.26 and a GuruFocus Value of $36.53, The Bancorp Inc has a price-to-GF-Value ratio of 1.05. This suggests that the stock is fairly valued based on its GF Value. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

The insider’s decision to sell shares could be based on a variety of factors, including personal financial needs or a belief that the stock’s current price accurately reflects its value. However, it’s important for investors to consider the broader context of insider transactions and other relevant market data before making investment decisions.

Story continues

As always, insider transactions should not be used in isolation to make investment decisions. Instead, they should be just one factor considered in a comprehensive analysis of a company’s financial health and market position.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.