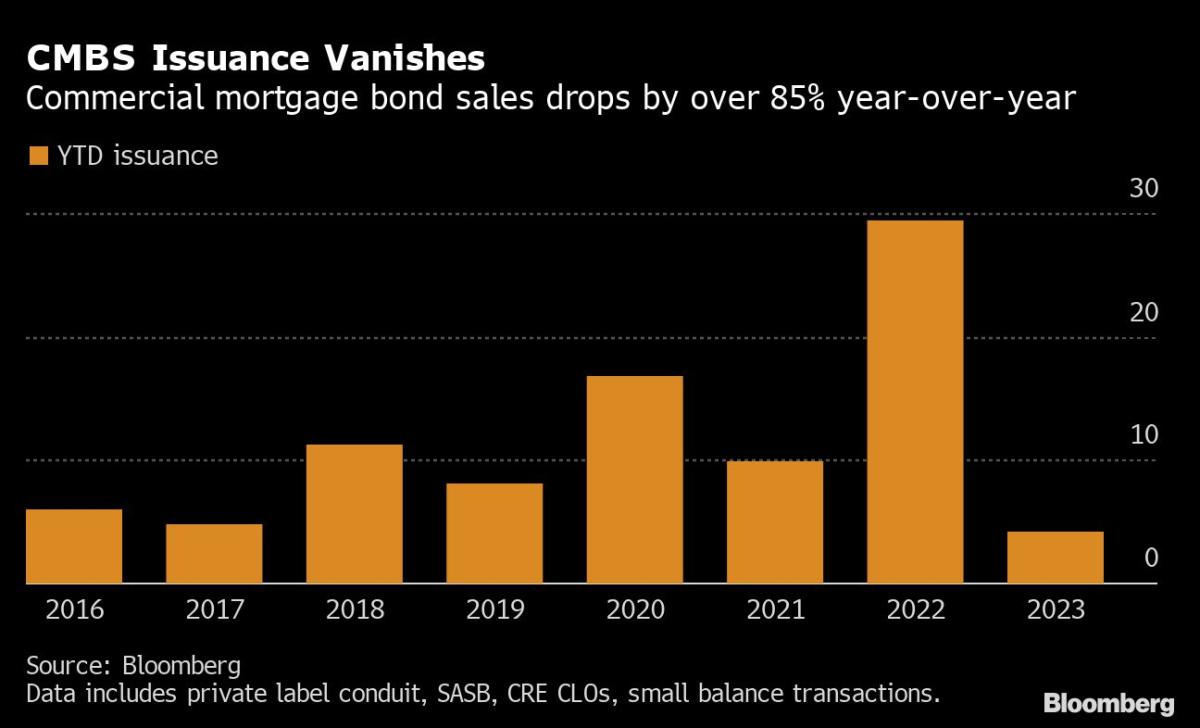

(Bloomberg) — Sales of commercial mortgage bonds have fallen off a cliff, plummeting about 85% year-over-year, as rising interest rates cut into lending volume and defaults spook investors.

Most Read from Bloomberg

Only about $4.27 billion of the bonds have been issued so far this year, down from $29.38 billion at this same point last year, according to data compiled by Bloomberg based on deals without government backing. Investors blame the Federal Reserve’s aggressive interest rate campaign, which has made it more expensive for borrowers to refinance. Higher rates have also cut into sales of properties by effectively lifting prices for buyers.

Adding pressure is a recent string of defaults in the office and retail property sectors, making bond buyers even more wary. This week, Bloomberg reported that Brookfield Corp., parent of the largest office landlord in downtown Los Angeles, defaulted on loans tied to two buildings instead of refinancing the debt as demand for space falls. Meanwhile, a loan tied to former President Donald Trump’s tower at 40 Wall St. in Manhattan was placed on a lender watchlist. And investors are trying to foreclose on one of the country’s largest malls — the Palisades Center in West Nyack, New York.

“Default risk has increased and could be more problematic if rates increase and the economy slows,” said Chris Sullivan, chief investment officer at United Nations Federal Credit Union. “So, I think a cautious and especially diligent approach is appropriate.”

The drop in lending volume follows a slowdown in real estate market activity, starting in the latter half of 2022 as the Fed began ramping up rates in earnest.

Story continues

Last year saw a 10% drop in commercial real estate loans — the underlying debt that typically gets repackaged into commercial mortgage bonds — compared to the year before, to $804 million from $891 million, according to Mortgage Bankers Association data. The trade group expects a further 15% drop in CRE loans in 2023, to $684 million, again slashing the amount of loans that can be securitized and sold.

“Everything is frozen, so there’s no raw material to make CMBS transactions,” said Paul Norris, head of structured products at insurance asset manager Conning & Co., in a phone interview.

Only a handful of deals have crossed the finish line in the last few weeks. Banks are even getting creative with deal structures to try to lure investors. Last week, a lender group led by Deutsche Bank AG priced a conduit CMBS totaling $765.5 million with a five-year maturity — an anomaly in a market that tends to sell longer dated debt.

“It’s very hard to bring new deals to market now, because there’s nothing happening in the real estate market,” said Norris. “No one wants to refinance their buildings and there’s a massive gap in terms of expectations between buyers and sellers due to the uncertainty.”

And the bulk of investor demand is likely to skew toward deals with excellent collateral performance and sponsorship, according to Sullivan. “Trophy properties will still be favored.”

To be sure, the CMBS index has been outperforming the broader investment-grade bond market, gaining 1.14% so far this year compared to the latter’s 0.85% gain, according to Bloomberg index data.

Cap Rates

The Fed’s hiking cycle has also led to higher cap rates, or capitalization rates, a measure similar to the yield on a bond. Lately these figures have been rising as property values have been falling, dampening transaction volume.

“No one wants to take a loss if they can help it,” said Lea Overby, CMBS strategist at Barclays Plc. US commercial property prices slumped 13% in 2022, according to Green Street, Bloomberg reported.

But with inflation staying persistently high and unemployment low, the Fed may have to keep hiking rates for longer. “If the risk of recession becomes more severe, that’ll be tough on the commercial real estate market,” she added.

For the rest of the year, Barclays estimates that CMBS issuance will stay low. For 2023, the bank forecasts $25 billion of conduit debt — or bonds backed by multiple properties. It anticipates $45 billion of single-asset, single-borrower bonds, or securities backed by mortgages on a single property.

“The market needs to learn how to function in this new rate regime, and reach a consensus of where things should price,” said Overby. “The sooner the market realizes this is the new reality, the better.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.