DWNTWN Realty Advisors once again proved its expertise in Miami’s dynamic real estate market by successfully brokering a $23.5 million sale in Wynwood. This landmark transaction illustrates DWNTWN’s unmatched ability to attract nationwide and international buyers for prime Miami Real estate Investments.

In this case study, we explore the key details of the property, the intricacies of the transaction, and the role DWNTWN played in securing this significant deal in one of Miami’s most sought-after neighborhoods.

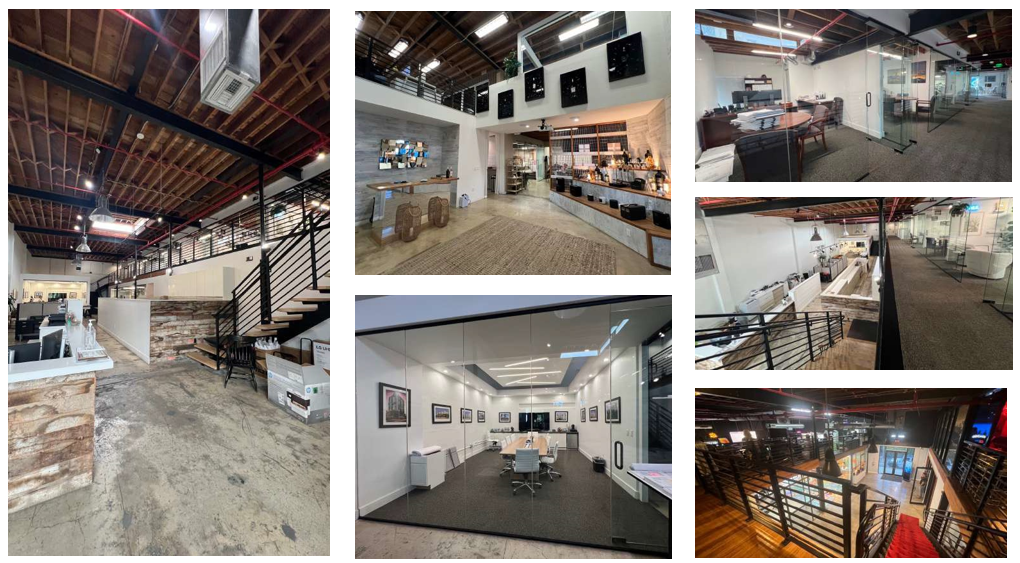

Wynwood Commercial Real Estate Sale: Project Overview

This transaction highlights the value of Wynwood’s burgeoning real estate market, known for its combination of creative, commercial, and residential developments. The property offers both immediate income and long-term development opportunities.

- Location: 2320-2328 North Miami Avenue & 36-38 NW 24th Street, Wynwood, Miami, FL

- Transaction Value: $23.5 million

- Zoning: T5-O & T6-8-O, providing development flexibility

- Buyer: Eric Benaim

- Seller: Doug Levine

- Property Size: 25,855 square feet of building space on a 31,500-square-foot lot

- Occupancy: Fully leased under NNN terms with leases expiring in 2027

- Key Features: NNN-covered land play, Development potential for up to 12 stories, 108–162 residential units or 216–324 hotel keys possible, Significant upside due to under-market rents

Understanding the Wynwood Mixed Use Retail Property Neighborhood Transaction

Wynwood, one of Miami’s most exciting and fast-evolving neighborhoods, is bordered by I-95 to the west, Edgewater to the east, Downtown and Brickell to the south, and Midtown and the Design District to the north. The district has transformed from an industrial area to a vibrant hub for art, fashion, and tech industries. Wynwood’s main streets are lined with world-class restaurants, creative spaces, and art galleries, making it a highly desirable location for both investors and tenants. The property in question is located near Wynwood 25, with high-profile neighbors including retail giants like Uchi, KYU, and Warby Parker.

Since 2009, the neighborhood has been shaped by initiatives like the Wynwood Walls and the Neighborhood Revitalization District-1 (NRD-1) rezoning plan, which promote street art, industrial preservation, and a live-work-play atmosphere. These factors have made Wynwood a magnet for tech companies like Blockchain.com and OpenStore, driving both commercial and residential demand.

Representing both the buyer and the seller in such a prime location required DWNTWN Realty Advisors to leverage its deep understanding of the neighborhood’s zoning and potential for future development, allowing both parties to benefit from a fair and profitable transaction.

DWNTWN’s Expertise in High-Value Mixed Use CRE Transactions

DWNTWN Realty Advisors demonstrated its unparalleled expertise in urban core real estate transactions by carefully managing both sides of this $23.5 million deal. Their comprehensive market analysis and nuanced understanding of Wynwood’s zoning and development landscape allowed for accurate property valuation and effective dual representation.

Key to the success of this deal was DWNTWN’s ability to:

- Accurately assess property value based on immediate income from existing tenants and future development opportunities.

- Navigate complex dual representation to ensure both the buyer’s and seller’s goals were met.

- Leverage market knowledge of Wynwood’s rapidly growing tech, creative, and residential industries.

Benefits of the Wynwood Commercial Real Estate Sale of the Mixed Use Retail Property

The $24.5 million transaction brought numerous benefits to both the buyer and the seller, highlighting the property’s immense potential in Miami’s hottest creative district.

- Immediate Cash Flow: The property is fully leased under NNN terms, providing instant income for the buyer with leases expiring in 2027.

- Development Potential: The zoning allows for a potential 12-story building with a mix of residential units, hotel keys, or commercial space, making it an attractive long-term investment.

- Prime Wynwood Location: As Wynwood continues to grow, this property sits in the center of a thriving creative and commercial hub, surrounded by tech startups, art galleries, and top-tier eateries.

- Under-Market Rents: The property offers significant upside due to current rental rates being below market, providing opportunities for future growth.

- Liquor License Advantage: The property includes an existing liquor warrant, making it attractive for potential retail or hospitality businesses.

- Strategic Relationships: By facilitating multiple transactions for the buyer and seller, DWNTWN strengthened its client relationships and secured future business opportunities.

Securing the Wynwood Mixed Use Real Estate Sale Transaction

DWNTWN Realty Advisors ensured a successful transaction through a meticulous and strategic approach. The team’s process was designed to cover all aspects of the sale, from initial consultations to closing.

- Consultation and Analysis: DWNTWN began by conducting detailed consultations with both the buyer and seller to understand their goals and ensure alignment.

- Comprehensive Property Analysis: The team performed an in-depth review of the property’s current income potential and future development prospects, incorporating Wynwood’s growing real estate trends.

- Market Research: DWNTWN provided detailed market analysis, comparing similar properties and assessing Wynwood’s growing demand for creative and mixed-use spaces.

- Negotiation: Using their unique position as advisors to both buyer and seller, DWNTWN expertly navigated the negotiation process to ensure both parties’ goals were met.

- Due Diligence and Closing: A thorough due diligence process ensured compliance with zoning and legal regulations, culminating in a smooth closing for both parties.

Results and Client Satisfaction

The successful $23.5 million CRE sale resulted in a win-win for both buyer and seller. The buyer secured a prime Wynwood commercial real estate sale with immediate income and substantial development potential, while the seller achieved an excellent return on investment. Both parties expressed satisfaction with DWNTWN’s professionalism, market knowledge, and seamless management of the transaction, further reinforcing the firm’s reputation as a leader in high-value commercial real estate in Miami.